Economy of the United States

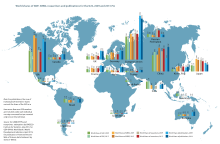

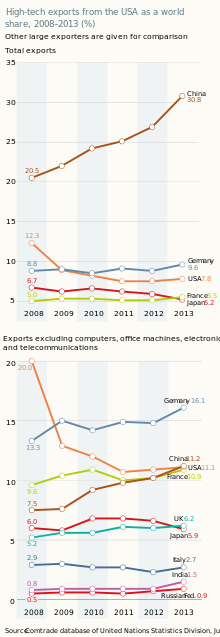

[54][55][56] The largest U.S. trading partners are Canada, Mexico, China, Japan, Germany, South Korea, the United Kingdom, Taiwan, India, and Vietnam.

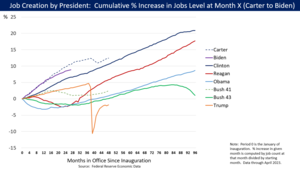

[72][73] The American Reinvestment and Recovery Act was enacted by the United States Congress, and in the ensuing years the U.S. experienced the longest economic expansion on record by July 2019.

[102] The approach, advanced by British economist John Maynard Keynes, gave elected officials a leading role in directing the economy since spending and taxes are controlled by the U.S. president and Congress.

The "Baby Boom" saw a dramatic increase in fertility in the period 1942–1957; it was caused by delayed marriages and childbearing during the depression years, a surge in prosperity, a demand for suburban single-family homes (as opposed to inner city apartments), and new optimism about the future.

[130] By June 2020, the slump in US continental flights due to the coronavirus pandemic had resulted in the US government temporarily halting service of fifteen US airlines to 75 domestic airports.

[171][172] Some scholars, including business theorist Jeffrey Pfeffer and political scientist Daniel Kinderman, posit that contemporary employment practices in the United States relating to the increased performance pressure from management, and the hardships imposed on employees such as toxic working environments, precarity, and long hours, could be responsible for 120,000 excess deaths annually, making the workplace the fifth leading cause of death in the United States.

[180] Between 2009 and 2010, following the Great Recession, the emerging problem of jobless recoveries resulted in record levels of long-term unemployment with more than six million workers looking for work for more than six months as of January 2010.

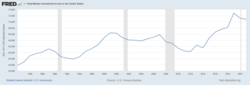

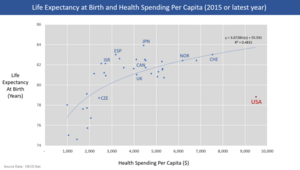

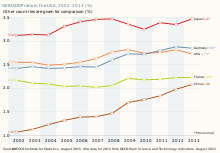

[203][160] According to one analysis middle-class incomes in the United States fell into a tie with those in Canada in 2010, and may have fallen behind by 2014, while several other advanced economies have closed the gap in recent years.

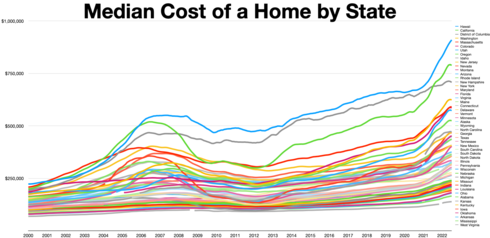

[237] As of 2018, the number of U.S. citizens residing in their vehicles increased in major cities with significantly higher than average housing costs such as Los Angeles, Portland and San Francisco.

[242][243] As of January 2024, in roughly half of cities in the U.S., workers need incomes of $100,000 or more in order to purchase a home as a result of rising housing prices and interest rate hikes.

[260] According to journalist and author Alissa Quart, the cost of living is rapidly outpacing the growth of salaries and wages, including those for traditionally secure professions such as teaching.

[263] Some experts assert that the US has experienced a "two-tier recovery", which has benefitted 60% of the population, while the other 40% on the "lower tier" have been struggling to pay bills as the result of stagnant wages, increases in the cost of housing, education and healthcare, and growing debts.

[286][287] A May 2018 report by the U.N. Special Rapporteur on extreme poverty and human rights found that over five million people in the United States live "in 'Third World' conditions".

[293][294][295] Sociologist Matthew Desmond writes in his 2023 book Poverty, by America that the US "offers some of the lowest wages in the industrialized world," which has "swelled the ranks of the working poor, most of whom are thirty-five or older.

"[296] Social scientist Mark Robert Rank asserts that the high rates of poverty in the U.S. can largely be explained as structural failures at the economic and political levels.

American companies such as Boeing, Cessna (see: Textron), Lockheed Martin (see: Skunk Works), and General Dynamics produce a majority of the world's civilian and military aircraft in factories across the United States.

[371] Americas ten largest trading partners are China, Canada, Mexico, Japan, Germany, South Korea, United Kingdom, France, India and Taiwan.

[391][394] In January 2012, the U.S. Treasury Borrowing Advisory Committee of the Securities Industry and Financial Markets Association unanimously recommended that government debt be allowed to auction even lower, at negative absolute interest rates.

In the years following the Great Depression, it devised a complex system to stabilize prices for agricultural goods, which tend to fluctuate wildly in response to rapidly changing supply and demand.

[427] While leaders of America's two most influential political parties generally favored economic deregulation during the 1970s, 1980s, and 1990s, there was less agreement concerning regulations designed to achieve social goals.

During the 1980s, the government relaxed labor, consumer and environmental rules based on the idea that such regulation interfered with free enterprise, increased the costs of doing business, and thus contributed to inflation.

The response to such changes is mixed; many Americans continued to voice concerns about specific events or trends, prompting the government to issue new regulations in some areas, including environmental protection.

In the United States, the corporation has emerged as an association of owners, known as stockholders, who form a business enterprise governed by a complex set of rules and customs.

Means of addressing the aging trend include immigration (which theoretically brings in younger workers) and higher fertility rates, which can be encouraged by incentives to have more children (e.g., tax breaks, subsidies, and more generous paid leave).

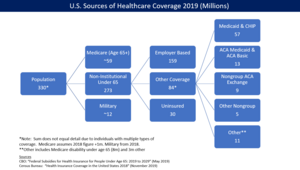

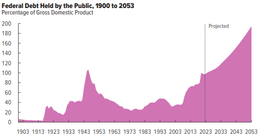

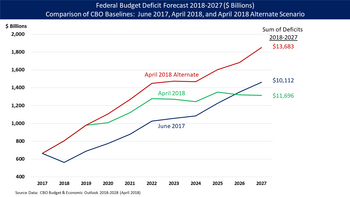

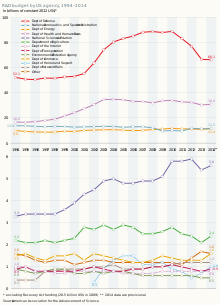

[455] The Congressional Budget Office estimated in May 2019 that mandatory spending (e.g., Medicare, Medicaid, and Social Security) will continue growing relative to the size of the economy (GDP) as the population ages.

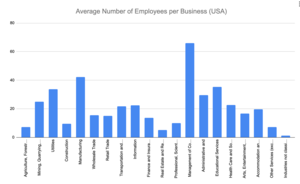

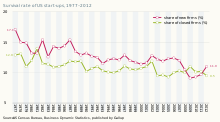

"[459] And in recent years, business creation has been documented by scholars such as David Audretsch to be a major driver of economic growth in both the United States and Western Europe.

Between 2000 and 2022's edition of the list, the top spot on the Fortune 500 was occupied by either the auto manufacturer General Motors (GM), the oil and gas giant ExxonMobil, or the retailer Walmart.

These firms range from hardware manufacturers like Dell Technologies, IBM, Hewlett-Packard, and Cisco, to software and computing infrastructure programmers like Oracle, Salesforce, Adobe, and Intuit.

Top ten U.S. banks by assets[485][486][487][488] A 2012 International Monetary Fund study concluded that the U.S. financial sector has grown so large that it is slowing economic growth.

New York University economist Thomas Philippon supported those findings, estimating that the U.S. spends $300 billion too much on financial services per year, and that the sector needs to shrink by 20%.

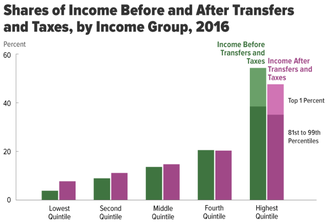

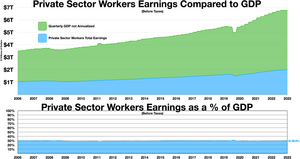

Private sector workers made ~$2 trillion or about 29.6% of all money earned in Q3 2023 (before taxes)