Insurance

Methods for transferring or distributing risk were practiced by Chinese and Indian traders as long ago as the 3rd and 2nd millennia BC, respectively.

It articulates the general average principle of marine insurance established on the island of Rhodes in approximately 1000 to 800 BC, plausibly by the Phoenicians during the proposed Dorian invasion and emergence of the purported Sea Peoples during the Greek Dark Ages (c. 1100–c.

[7] In 1816, an archeological excavation in Minya, Egypt produced a Nerva–Antonine dynasty-era tablet from the ruins of the Temple of Antinous in Antinoöpolis, Aegyptus.

The tablet prescribed the rules and membership dues of a burial society collegium established in Lanuvium, Italia in approximately 133 AD during the reign of Hadrian (117–138) of the Roman Empire.

His article detailed an historical account of a Severan dynasty-era life table compiled by the Roman jurist Ulpian in approximately 220 AD that was also included in the Digesta.

However, the money would not be repaid at all if the ship were lost, thus making the rate of interest high enough to pay for not only for the use of the capital but also for the risk of losing it (fully described by Demosthenes).

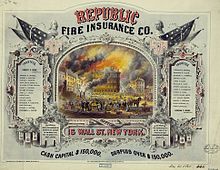

By the end of the seventeenth century, London's growth as a centre for trade was increasing due to the demand for marine insurance.

The first company to offer life insurance was the Amicable Society for a Perpetual Assurance Office, founded in London in 1706 by William Talbot and Sir Thomas Allen.

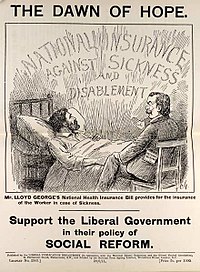

In the 1880s Chancellor Otto von Bismarck introduced old age pensions, accident insurance and medical care that formed the basis for Germany's welfare state.

[24] This system was greatly expanded after the Second World War under the influence of the Beveridge Report, to form the first modern welfare state.

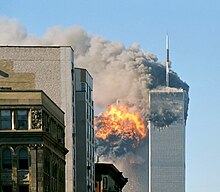

Several commonly cited legal principles of insurance include:[29] To "indemnify" means to make whole again, or to be reinstated to the position that one was in, to the extent possible, prior to the happening of a specified event or peril.

[34] Insurers attempt to address carelessness through inspections, policy provisions requiring certain types of maintenance, and possible discounts for loss mitigation efforts.

Insurers' business model aims to collect more in premium and investment income than is paid out in losses, and to also offer a competitive price which consumers will accept.

More complex multivariate analyses are sometimes used when multiple characteristics are involved and a univariate analysis could produce confounded results.

Bear markets do cause insurers to shift away from investments and to toughen up their underwriting standards, so a poor economy generally means high insurance-premiums.

Incoming claims are classified based on severity and are assigned to adjusters, whose settlement authority varies with their knowledge and experience.

In managing the claims-handling function, insurers seek to balance the elements of customer satisfaction, administrative handling expenses, and claims overpayment leakages.

Life insurance policies often allow the option of having the proceeds paid to the beneficiary either in a lump sum cash payment or an annuity.

Annuities and pensions that pay a benefit for life are sometimes regarded as insurance against the possibility that a retiree will outlive his or her financial resources.

In many countries, such as the United States and the UK, the tax law provides that the interest on this cash value is not taxable under certain circumstances.

The Greeks and Romans introduced burial insurance c. 600 CE when they organized guilds called "benevolent societies" which cared for the surviving families and paid funeral expenses of members upon death.

The risk presented by any given person is assumed collectively by the community who all bear the cost of rebuilding lost property and supporting people whose needs are suddenly greater after a loss of some kind.

If a government building was damaged, the cost of repair would be met from public funds because, in the long run, this was cheaper than paying insurance premiums.

They are self-funded cooperatives, operating as carriers of coverage for the majority of governmental entities today, such as county governments, municipalities, and school districts.

However, self-insured pools offer members lower rates (due to not needing insurance brokers), increased benefits (such as loss prevention services) and subject matter expertise.

Captives represent commercial, economic and tax advantages to their sponsors because of the reductions in costs they help create and for the ease of insurance risk management and the flexibility for cash flows they generate.

In response to these issues, many countries have enacted detailed statutory and regulatory regimes governing every aspect of the insurance business, including minimum standards for policies and the ways in which they may be advertised and sold.

[78] Redlining is the practice of denying insurance coverage in specific geographic areas, supposedly because of a high likelihood of loss, while the alleged motivation is unlawful discrimination.

[citation needed] That is, some insurance products or practices are useful primarily because of legal benefits, such as reducing taxes, as opposed to providing protection against risks of adverse events.

[citation needed] Jewish rabbinical scholars also have expressed reservations regarding insurance as an avoidance of God's will but most find it acceptable in moderation.