Government budget balance

The government budget surplus or deficit is a flow variable, since it is an amount per unit of time (typically, per year).

The collapse is explained by the massive shift of the private sector from financial deficit into surplus or, in other words, from boom to bust.

"[3] Economist Paul Krugman explained in December 2011 the causes of the sizable shift from private deficit to surplus: "This huge move into surplus reflects the end of the housing bubble, a sharp rise in household saving, and a slump in business investment due to lack of customers.

This is because a budget deficit means that a government has deposited, over the course of some time range, more money and bonds into private holdings than it has removed in taxes.

A budget surplus means the opposite: in total, the government has removed more money and bonds from private holdings via taxes than it has put back in via spending.

If investors anticipate future inflation, however, they will demand higher interest rates on government debt, making public borrowing more expensive.

Conversely, at the peak of the cycle, unemployment is low, increasing tax revenue and decreasing social security spending.

These loans became popular when private financiers had amassed enough capital to provide them, and when governments were no longer able to simply print money, with consequent inflation, to finance their spending.

To reduce their borrowing costs, governments began to issue bonds that were payable to the bearer (rather than the original purchaser) so that the lenders could sell on some or all of the debt to someone else.

As Professor William Vickrey, awarded with the 1996 Nobel Memorial Prize in Economic Sciences put it: Deficits are considered to represent sinful profligate spending at the expense of future generations who will be left with a smaller endowment of invested capital.

This added purchasing power, when spent, provides markets for private production, inducing producers to invest in additional plant capacity, which will form part of the real heritage left to the future.

Deficits in excess of a gap growing as a result of the maximum feasible growth in real output might indeed cause problems, but we are nowhere near that level.

If General Motors, AT&T, and individual households had been required to balance their budgets in the manner being applied to the Federal government, there would be no corporate bonds, no mortgages, no bank loans, and many fewer automobiles, telephones, and houses.

Unemployment rate/output growth/output gap are variables measuring the responsibility of government practising fiscal policy to macroeconomic terms.

In addition, increase of interest rate is an important mean of monetary policy to regulate the inflation, which clears the value of debt.

[15] However, Greece and Japan are considered as developed countries, but their debt is one of the highest in the world and any significant increase of interest rates would lead to huge financial problems, therefore this assumption is quite problematic.

The economic institutions, among them those, which apply fiscal policy, are directly influenced by de jure (under the law) political power.

According to Alesina, Favor & Giavazzi (2018), "we recognized that shifts in fiscal policy typically come in the form of multiyear plans adopted by governments with the aim of reducing the debt-to-GDP ratio over a period of time-typically three to four years.

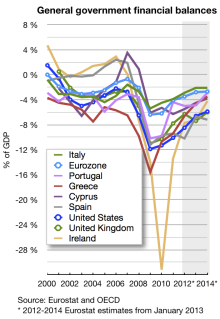

the United States has faced a growing concern over its government budget balance, with both deficits and surpluses having significant implications for the economy and society as a whole.

It is important to note that these policy solutions can have significant implications for the economy and society, and their effectiveness in reducing deficits may vary depending on various factors, such as economic conditions and political climate.

To address issues regarding the government budget balance, policymakers in the United States have implemented various policy solutions and legislation.

[28] Proponents of this legislation argued that it would stimulate economic growth and create jobs, while opponents raised concerns about its impact on the federal deficit.

[28] There are also ongoing debates regarding entitlement programs, such as Social Security and Medicare, which account for a significant portion of federal spending.

Some policymakers have proposed changes to these programs, such as raising the retirement age or means-testing benefits, in order to reduce the federal deficit.

For example, the Budget Control Act of 2011 has led to reductions in federal spending that have had a significant impact on various programs and services.

While this has helped to reduce the federal deficit, it has also raised concerns about the impact on individuals and communities that rely on these programs.

Budget reconciliation is an optional procedure used in some years to facilitate the passage of legislation amending tax or spending law.

[29] It allows lawmakers to advance spending and tax policies through the Senate with a simple majority, rather than the 60 votes typically needed to overcome a filibuster.

If PAYGO requirements are not met, automatic spending cuts (known as sequestration) may be triggered to offset the increase in the deficit.

Overall, the implementation of policy solutions and legislation to address issues regarding the government budget balance is a complex and ongoing process that requires careful consideration of a range of factors and potential implications.