History of economic thought

Fan Li (also known as Tao Zhu Gong) (born 517 BCE),[4] an adviser to King Goujian of Yue, wrote on economic issues and developed a set of "golden" business rules.

"[12] Aristotle's Politics (c. 350 BC) analyzed different forms of the state (monarchy, aristocracy, constitutional government, tyranny, oligarchy, and democracy) as a critique of Plato's model of rule by philosopher-kings.

Thus observing the effect of American silver and gold arrivals in Spain, namely lessening of their values and augmentation of prices, Martín de Azpilcueta established the idea of a value-scarcity, first form of the quantity theory of money.

In 1568 Jean Bodin (1530–1596) of France published Reply to Malestroit, containing the first known analysis of inflation, which he claimed was caused by importation of gold and silver from South America, backing the quantity theory of money.

In 1605 Flemish Jesuit theologian Leonardus Lessius (1554–1623) published On Justice and Law, the deepest moral-theological study of economics since Aquinas, whose just price approach he claimed was no longer workable.

English economist Thomas Mun (1571–1641) describes early mercantilist policy in his book England's Treasure by Foreign Trade, which was not published until 1664, although it was widely circulated in manuscript form during his lifetime.

Opportunities should be sought night and day for selling the country's superfluous goods to these foreigners in manufactured form... No importation should be allowed under any circumstances of which there is a sufficient supply of suitable quality at home.Nationalism, self-sufficiency and national power were the basic policies proposed.

In 1696 British mercantilist Tory Member of parliament Charles Davenant (1656–1714) published Essay on the East India Trade, displaying the first understanding of consumer demand and perfect competition.

Emperor Aurangzeb (r. 1658–1707), ruler of the Mughal India, compiled the sharia based Fatawa-e-Alamgiri along several Muslim scholars which include Islamic economics,[37][38] whose policies eventually led to the period of Proto-industrialization.

In fact, virtue (which he defined as "every performance by which man, contrary to the impulse of nature, should endeavour the benefit of others, or the conquest of his own passions, out of a rational ambition of being good") is actually detrimental to the state in its commercial and intellectual progress.

Francis Hutcheson (1694–1746), the teacher of Adam Smith from 1737 to 1740[46] is considered the end of a long tradition of thought on economics as "household or family (οἶκος) management",[47][48][49] stemming from Xenophon's work Oeconomicus.

"[52] Over the end of the seventeenth and beginning of the eighteenth century major advances in natural science and anatomy included the discovery of blood circulation through the human body – documented by William Harvey in 1628.

The times produced a common need among thinkers to explain social upheavals of the Industrial Revolution taking place, and in the seeming chaos without the feudal and monarchical structures of Europe, show there was order still.

Bentham was an atheist, a prison reformer, animal rights activist, believer in universal suffrage, freedom of speech, free trade and health insurance at a time when few dared to argue for any of these ideas.

He viewed math as a way to simplify economic reasoning, although he had reservations as revealed in a letter to his student Arthur Cecil Pigou:[64][76] (1) Use mathematics as shorthand language, rather than as an engine of inquiry.

Also in 1917, the United States of America entered the war on the side of the Allies (France and Britain), with President Woodrow Wilson claiming to be "making the world safe for democracy", devising a peace plan of Fourteen Points.

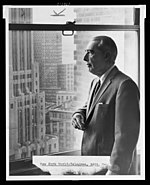

One of the most original contributions to understanding what went wrong came from Harvard University lawyer Adolf Berle (1895–1971), who like John Maynard Keynes had resigned from his diplomatic job at the Paris Peace Conference, 1919 and was deeply disillusioned by the Versailles Treaty.

Overpopulation had been discussed in an essay by Thomas Malthus (see Malthusian catastrophe), while John Stuart Mill foresaw the desirability of a stationary state economy, thus anticipating concerns of the modern discipline of ecological economics.

Issues of intergenerational equity, irreversibility of human impact on the environment, uncertainty of long-term outcomes, thermodynamics limits to growth, and sustainable development guide ecological economic analysis and valuation.

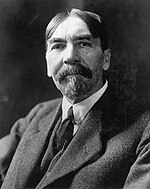

In 1934 John R. Commons (1862–1945), another economist from midwestern America published Institutional Economics (1934), based on the concept that the economy is a web of relationships between people with diverging interests, including monopolies, large corporations, labor disputes, and fluctuating business cycles.

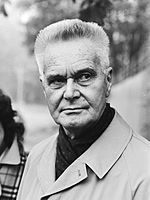

In the 1930s the Stockholm School of Economics was founded by Eli Heckscher (1879–1952), Bertil Ohlin (1899–1977), Gunnar Myrdal (1898–1987) et al. based on the works of John Maynard Keynes and Knut Wicksell (1851–1926), advising the founders of the Swedish Socialist welfare state.

[108] Keynes finished his treatise by advocating, first, a reduction in reparation payments by Germany to a realistically manageable level, increased intra-governmental management of continental coal production and a free trade union through the League of Nations;[109] second, an arrangement to set off debt repayments between the Allied countries;[110] third, complete reform of international currency exchange and an international loan fund;[111] and fourth, a reconciliation of trade relations with Russia and Eastern Europe.

Eichner's writings and advocacy of thought, differed with the theories of John Maynard Keynes, who was an advocate of government intervention in the free market and proponent of public spending to increase employment.

John Hicks (1904–1989) of England was a Keynesian who in 1937 proposed the Investment Saving – Liquidity Preference Money Supply Model, which treats the intersection of the IS and LM curves as the general equilibrium in both markets.

[117] In 1985 George Akerlof (1940–) and Janet Yellen (1946–) published menu costs arguments showing that, under imperfect competition, small deviations from rationality generate significant (in welfare terms) price stickiness.

[122] Coase said that regardless of whether the judge ruled that the sweets maker had to stop using his machinery, or that the doctor had to put up with it, they could strike a mutually beneficial bargain about who moves house that reaches the same outcome of resource distribution.

Assuming competitive markets, real business cycle theory implies that cyclical fluctuations are optimal responses to variability in technology and tastes, and that macroeconomic stabilization policies must reduce welfare.

Whilst Richard Cantillon had imitated Isaac Newton's mechanical physics of inertia and gravity in competition and the market,[42] the physiocrats had copied the body's blood system into circular flow of income models, William Jevons had found growth cycles to match the periodicity of sunspots, Samuelson adapted thermodynamics formulae to economic theory.

Indian economist Amartya Sen (1933–) expressed considerable skepticism about the validity of neoclassical assumptions, and was highly critical of rational expectations theory, devoting his work to Development Economics and human rights.

In 1986 French economist Jean Tirole (1953–) published "Dynamic Models of Oligopoly", followed by "The Theory of Industrial Organization" (1988), launching his quest to understand market power and regulation, resulting in the 2014 Nobel Economics Prize.