Subprime mortgage crisis

Defaults and foreclosure activity increased dramatically as easy initial terms expired, home prices fell, and adjustable-rate mortgage (ARM) interest rates reset higher.

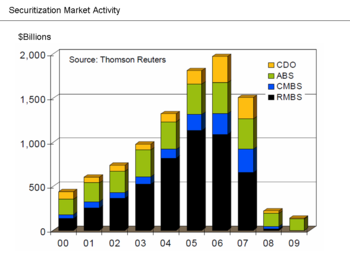

[17] The complexity of these off-balance sheet arrangements and the securities held, as well as the interconnection between larger financial institutions, made it virtually impossible to re-organize them via bankruptcy, which contributed to the need for government bailouts.

At the same time, weak underwriting standards, unsound risk management practices, increasingly complex and opaque financial products, and consequent excessive leverage combined to create vulnerabilities in the system.

[90] Warren Buffett testified to the Financial Crisis Inquiry Commission: "There was the greatest bubble I've ever seen in my life...The entire American public eventually was caught up in a belief that housing prices could not fall dramatically.

[143]The Economist reported in March 2010: "Bear Stearns and Lehman Brothers were non-banks that were crippled by a silent run among panicky overnight "repo" lenders, many of them money market funds uncertain about the quality of securitized collateral they were holding.

[195] In addition, Chicago Public Radio, Huffington Post, and ProPublica reported in April 2010 that market participants, including a hedge fund called Magnetar Capital, encouraged the creation of CDO's containing low quality mortgages, so they could bet against them using CDS.

[219] Despite the profitability of the three big credit agencies – Moody's operating margins were consistently over 50%, higher than famously successful ExxonMobil or Microsoft[220] – salaries and bonuses for non-management were significantly lower than at Wall Street banks, and its employees complained of overwork.

"[236] The Commodity Futures Modernization Act of 2000 was bi-partisan legislation that formally exempted derivatives from regulation, supervision, trading on established exchanges, and capital reserve requirements for major participants.

[238][239] Former Fed Chair Alan Greenspan, who many economists blamed for the financial crisis, testified in October 2008 that he had trusted free markets to self-correct and had not anticipated the risk of reduced lending standards.

The critics believe that changes in the capital reserve calculation rules enabled investment banks to substantially increase the level of debt they were taking on, fueling the growth in mortgage-backed securities supporting subprime mortgages.

[261] As early as February 2004, in testimony before the U.S. Senate Banking Committee, Alan Greenspan (chairman of the Federal Reserve) raised serious concerns regarding the systemic financial risk that Fannie Mae and Freddie Mac represented.

[267] Economist Russell Roberts[268] cites a June 2008 Washington Post article which stated that "[f]rom 2004 to 2006, the two [GSEs] purchased $434 billion in securities backed by subprime loans, creating a market for more such lending.

[271] According to financial analyst Karen Petrou, "The SEC's facts paint a picture in which it wasn't high-minded government mandates that did the GSEs wrong, but rather the monomaniacal focus of top management on marketshare.

Another senior Fannie Mae executive stated: "Everybody understood that we were now buying loans that we would have previously rejected, and that the models were telling us that we were charging way too little, but our mandate was to stay relevant and to serve low-income borrowers.

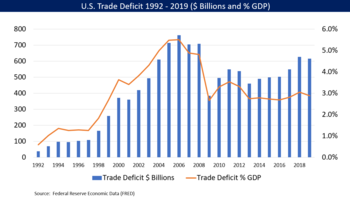

[291] Agreeing with Fisher that the low interest rate policy of the Greenspan Fed both allowed and motivated investors to seek out risk investments offering higher returns, is finance economist Raghuram Rajan who argues that the underlying causes of the American economy's tendency to go "from bubble to bubble" fueled by unsustainable monetary stimulation, are the "weak safety nets" for the unemployed, which made "the US political system ... acutely sensitive to job growth";[292] and attempts to compensate for the stagnant income of the middle and lower classes with easy credit to boost their consumption.

This dynamic of margin call and price reductions contributed to the collapse of two Bear Stearns hedge funds in July 2007, an event which economist Mark Zandi referred to as "arguably the proximate catalyst" of the crisis in financial markets.

Unable to withstand the combination of high leverage, reduced access to capital, loss in the value of its MBS securities portfolio, and claims from its hedge funds, Bear Stearns collapsed during March 2008.

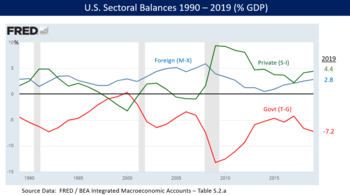

[342]Economist Martin Wolf analyzed the relationship between cumulative GDP growth from 2008 to 2012 and total reduction in budget deficits due to austerity policies (see chart) in several European countries during April 2012.

[344] Economist Paul Krugman analyzed the relationship between GDP and reduction in budget deficits for several European countries in April 2012 and concluded that austerity was slowing growth, similar to Martin Wolf.

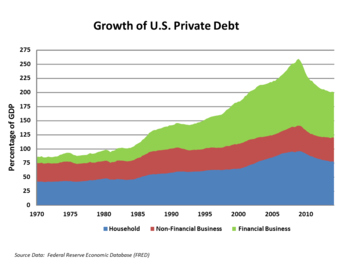

Economist Richard Koo described similar effects for several of the developed world economies in December 2011:Today private sectors in the U.S., the U.K., Spain, and Ireland (but not Greece) are undergoing massive deleveraging in spite of record low interest rates.

These firms had typically borrowed and invested large sums of money relative to their cash or equity capital, meaning they were highly leveraged and vulnerable to unanticipated credit market disruptions.

[178] The five largest U.S. investment banks, with combined liabilities or debts of $4 trillion, either went bankrupt (Lehman Brothers), were taken over by other companies (Bear Stearns and Merrill Lynch), or were bailed out by the U.S. government (Goldman Sachs and Morgan Stanley) during 2008.

[379] Government-sponsored enterprises (GSE) Fannie Mae and Freddie Mac either directly owed or guaranteed nearly $5 trillion in mortgage obligations, with a similarly weak capital base, when they were placed into conservatorship in September 2008.

[391] This argument suggests that Mr. Greenspan sought to enlist banks to expand lending and debt to stimulate asset prices and that the Federal Reserve and US Treasury Department would back any losses that might result.

[405] In February 2009, economists Nouriel Roubini and Mark Zandi (ignoring the impact on lenders, and the alternative advocated by others of providing the money to homeowners) recommended an "across the board" (systemic) reduction of mortgage principal balances by 20–30%.

[410][411][412] Untold thousands of people have complained in recent years that they were subjected to a nightmare experience of lost paperwork, misapplied fees and Kafkaesque phone calls with clueless customer service representatives as they strived to avoid foreclosures they say were preventable.

The U.S. Federal Bureau of Investigation probed the possibility of fraud by mortgage financing companies Fannie Mae and Freddie Mac, Lehman Brothers, and insurer American International Group, among others.

[421] New York Attorney General Andrew Cuomo sued Long Island based Amerimod, one of the nation's largest loan modification corporations for fraud, and issued numerous subpoenas to other similar companies.

The former tells the story from the perspective of several investors who bet against the housing market, while the latter follows key government and banking officials focusing on the critical events of September 2008, when many large financial institutions faced or experienced collapse.

Donna Fancher researched to find if the "American Dream" of owning a home is still a realistic goal, or if it is continually shrinking for the youth of the US, writing: "The value of owner-occupied housing also exceeds income growth.