Actuarial science

Actuarial science is the discipline that applies mathematical and statistical methods to assess risk in insurance, pension, finance, investment and other industries and professions.

In many countries, actuaries must demonstrate their competence by passing a series of rigorous professional examinations focused in fields such as probability and predictive analysis.

The science has gone through revolutionary changes since the 1980s due to the proliferation of high speed computers and the union of stochastic actuarial models with modern financial theory.

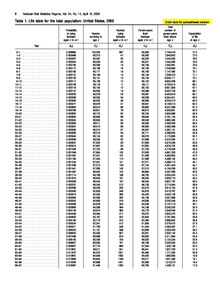

This requires estimating future contingent events, such as the rates of mortality by age, as well as the development of mathematical techniques for discounting the value of funds set aside and invested.

The insurance industry also provides coverage for exposures such as catastrophe, weather-related risks, earthquakes, patent infringement and other forms of corporate espionage, terrorism, and "one-of-a-kind" (e.g., satellite launch).

[citation needed] There is an increasing trend to recognize that actuarial skills can be applied to a range of applications outside the traditional fields of insurance, pensions, etc.

These models attempt to predict the chance of re-offending according to rating factors which include the type of crime, age, educational background and ethnicity of the offender.

Actuarial models and associated tables, such as the MnSOST-R, Static-99, and SORAG, have been used since the late 1990s to determine the likelihood that a sex offender will re-offend and thus whether he or she should be institutionalized or set free.

[9] Traditional actuarial science and modern financial economics in the US have different practices, which is caused by different ways of calculating funding and investment strategies, and by different regulations.

[10] As a result, actuarial science developed along a different path, becoming more reliant on assumptions, as opposed to the arbitrage-free risk-neutral valuation concepts used in modern finance.

[13] Today, the profession, both in practice and in the educational syllabi of many actuarial organizations, is cognizant of the need to reflect the combined approach of tables, loss models, stochastic methods, and financial theory.

Financial economists argue that pension benefits are bond-like and should not be funded with equity investments without reflecting the risks of not achieving expected returns.

The current debate now seems to be focusing on four principles: Essentially, financial economics state that pension assets should not be invested in equities for a variety of theoretical and practical reasons.

[17] Other early examples of mutual surety and assurance pacts can be traced back to various forms of fellowship within the Saxon clans of England and their Germanic forebears, and to Celtic society.

The computations of life insurance premiums and reserving requirements are rather complex, and actuaries developed techniques to make the calculations as easy as possible, for example "commutation functions" (essentially precalculated columns of summations over time of discounted values of survival and death probabilities).

The 1920 revision for the New-York based National Council on Workmen's Compensation Insurance rates took over two months of around-the-clock work by day and night teams of actuaries.