Causes of the Great Depression

The first are the demand-driven theories, from Keynesian and institutional economists who argue that the depression was caused by a widespread loss of confidence that led to drastically lower investment and persistent underconsumption.

[7] In his book The General Theory of Employment, Interest and Money (1936), British economist John Maynard Keynes introduced concepts that were intended to help explain the Great Depression.

[9] Hoover chose to do the opposite of what Keynes thought to be the solution and allowed the federal government to raise taxes exceedingly to reduce the budget shortage brought about by the depression.

The result was what Friedman and Schwartz called "The Great Contraction"[10] — a period of falling income, prices, and employment caused by the choking effects of a restricted money supply.

[11] In a speech honoring Friedman and Schwartz, Ben Bernanke stated: "Let me end my talk by abusing slightly my status as an official representative of the Federal Reserve.

"[20] Monetarist explanations had been rejected in Samuelson's work Economics, writing: "Today few economists regard Federal Reserve monetary policy as a panacea for controlling the business cycle.

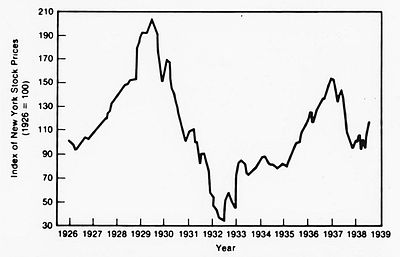

[25]Furthermore, Jerome says that the volume of new capital issues increased at a 7.7% compounded annual rate from 1922 to 1929 at a time when the Standard Statistics Co.'s index of 60 high grade bonds yielded from 4.98% in 1923 to 4.47% in 1927.

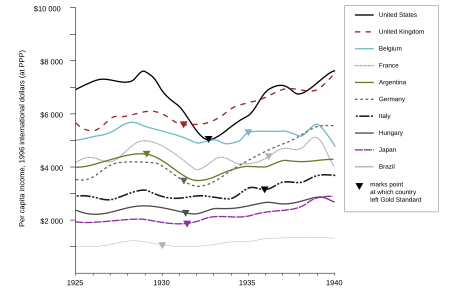

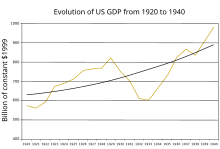

This thesis is based on the observation that after years of deflation and a very severe recession, important economic indicators turned positive in March 1933, just as Franklin D. Roosevelt took office.

The analysis suggests that the elimination of the policy dogmas of the gold standard, a balanced budget in times of crises and small government led to a large shift in expectation that accounts for about 70–80 percent of the recovery of output and prices from 1933 to 1937.

[45] However, in 1975, Hayek admitted that he made a mistake in the 1930s in not opposing the Central Bank's deflationary policy and stated the reason why he had been ambivalent: "At that time I believed that a process of deflation of some short duration might break the rigidity of wages which I thought was incompatible with a functioning economy.

[47] Concordantly, economist Lawrence White argues that the business cycle theory of Hayek is inconsistent with a monetary policy which permits a severe contraction of the money supply.

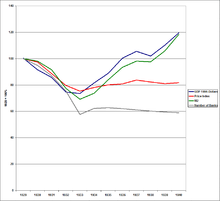

It was further noted that agriculture was adversely affected by the reduced need for animal feed as horses and mules were displaced by inanimate sources of power following World War I.

[64] Economists such as Waddill Catchings, William Trufant Foster, Rexford Tugwell, Adolph Berle (and later John Kenneth Galbraith), popularized a theory that had some influence on Franklin D.

[52] According to this view, the root cause of the Great Depression was a global overinvestment while the level of wages and earnings from independent businesses fell short of creating enough purchasing power.

[70] The reserve banks led the United States into an even deeper depression between 1931 and 1933, due to their failure to appreciate and put to use the powers they withheld – capable of creating money – as well as the "inappropriate monetary policies pursued by them during these years".

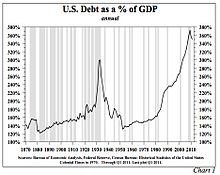

This policy, forcing a 30% deflation of the dollar that inevitably damaged the U.S. economy, is stated by Timberlake as being arbitrary and avoidable, the existing gold standard having been capable of continuing without it: Economic historians (especially Friedman and Schwartz) emphasize the importance of numerous bank failures.

[80] Protectionism, such as the American Smoot–Hawley Tariff Act, is often indicated as a cause of the Great Depression, with countries enacting protectionist policies yielding a beggar thy neighbor result.

The Smoot–Hawley Tariff Act was instituted by Senator Reed Smoot and Representative Willis C. Hawley, and signed into law by President Hoover, to raise taxes on American imports by about 20 percent during June 1930.

[83] In response to the Smoot–Hawley Tariff Act, some of America's primary producers and largest trading partner, Canada, chose to seek retribution by increasing the financial value of imported goods favoured by the Americans.

It was the debt as a result of the war, fewer families being formed, and an imbalance of mortgage payments and loans in 1928–29, that mainly contributed to the decline in the number of houses being built.

[98] In his memoirs, President Hoover wrote bitterly about members of his Cabinet who had advised inaction during the downslide into the Great Depression: The leave-it-alone liquidationists headed by Secretary of the Treasury Mellon ... felt that government must keep its hands off and let the slump liquidate itself.

The function of a depression is to liquidate failed investments and businesses that have been made obsolete by technological development in order to release factors of production (capital and labor) from unproductive uses.

[93] Economists such as John Maynard Keynes and Milton Friedman suggested that the do-nothing policy prescription which resulted from the liquidationist theory contributed to deepening the Great Depression.

[95] With the rhetoric of ridicule, Keynes tried to discredit the liquidationist view in presenting Hayek, Robbins and Schumpeter as ...austere and puritanical souls [who] regard [the Great Depression] ... as an inevitable and a desirable nemesis on so much "overexpansion" as they call it ...

[99] In a talk in 1975, Hayek admitted the mistake he made over forty years earlier in not opposing the Central Bank's deflationary policy and stated the reason why he had been "ambivalent": "At that time I believed that a process of deflation of some short duration might break the rigidity of wages which I thought was incompatible with a functioning economy.

[102][103] In 1932 Hoover reluctantly established the Reconstruction Finance Corporation, a Federal agency with the authority to lend up to $2 billion to rescue banks and restore confidence in financial institutions.

"The German mark collapsed when the chancellor put domestic politics ahead of sensible finance; the bank of England abandoned the gold standard after a subsequent speculative attack; and the U.S. Federal Reserve raised its discount rate dramatically in October 1931 to preserve the value of the dollar".

[84] According to Peter Temin, Barry Wigmore, Gauti B. Eggertsson and Christina Romer the biggest primary impact of the New Deal on the economy and the key to recovery and to end the Great Depression was brought about by a successful management of public expectations.

The analysis suggests that the elimination of the policy dogmas of the gold standard, balanced budget and small government led to a large shift in expectation that accounts for about 70–80 percent of the recovery of output and prices from 1933 to 1937.

The NIRA suspended antitrust laws and permitted collusion in some sectors provided that industry raised wages above clearing level and accepted collective bargaining with labor unions.