Copula (statistics)

[1] Their name, introduced by applied mathematician Abe Sklar in 1959, comes from the Latin for "link" or "tie", similar but unrelated to grammatical copulas in linguistics.

Copulas have been used widely in quantitative finance to model and minimize tail risk[2] and portfolio-optimization applications.

By applying the probability integral transform to each component, the random vector has marginals that are uniformly distributed on the interval [0, 1].

The reverse of these steps can be used to generate pseudo-random samples from general classes of multivariate probability distributions.

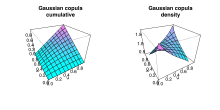

[5][6] Sklar's theorem states that every multivariate cumulative distribution function of a random vector

[8] Thus, a very important pre-processing step is to check for the auto-correlation, trend and seasonality within time series.

For the former, copulas are used to perform stress-tests and robustness checks that are especially important during "downside/crisis/panic regimes" where extreme downside events may occur (e.g., the global financial crisis of 2007–2008).

The formula was also adapted for financial markets and was used to estimate the probability distribution of losses on pools of loans or bonds.

During a downside regime, a large number of investors who have held positions in riskier assets such as equities or real estate may seek refuge in 'safer' investments such as cash or bonds.

This is also known as a flight-to-quality effect and investors tend to exit their positions in riskier assets in large numbers in a short period of time.

[22][23] For example, anecdotally, we often read financial news headlines reporting the loss of hundreds of millions of dollars on the stock exchange in a single day; however, we rarely read reports of positive stock market gains of the same magnitude and in the same short time frame.

For example, consider the stock exchange as a market consisting of a large number of traders each operating with his/her own strategies to maximize profits.

Therefore, copulas allow us to analyse the interaction effects which are of particular interest during downside regimes as investors tend to herd their trading behaviour and decisions.

(See also agent-based computational economics, where price is treated as an emergent phenomenon, resulting from the interaction of the various market participants, or agents.)

[24][25] Thus, previously, scalable copula models for large dimensions only allowed the modelling of elliptical dependence structures (i.e., Gaussian and Student-t copulas) that do not allow for correlation asymmetries where correlations differ on the upside or downside regimes.

[27] The Clayton canonical vine copula allows for the occurrence of extreme downside events and has been successfully applied in portfolio optimization and risk management applications.

Panic copulas are created by Monte Carlo simulation, mixed with a re-weighting of the probability of each scenario.

Therefore, modeling approaches using the Gaussian copula exhibit a poor representation of extreme events.

[34][35][36] Additional to CDOs, copulas have been applied to other asset classes as a flexible tool in analyzing multi-asset derivative products.

Copulas have since gained popularity in pricing and risk management[38] of options on multi-assets in the presence of a volatility smile, in equity-, foreign exchange- and fixed income derivatives.

[41] Researchers are also trying these functions in the field of transportation to understand the interaction between behaviors of individual drivers which, in totality, shapes traffic flow.

Copulas are being used for reliability analysis of complex systems of machine components with competing failure modes.

[44][45] Copulæ have many applications in the area of medicine, for example, The combination of SSA and copula-based methods have been applied for the first time as a novel stochastic tool for Earth Orientation Parameters prediction.

Theoretical studies adopted the copula-based methodology for instance to gain a better understanding of the dependence structures of temperature and precipitation, in different parts of the world.

[9][62][63] Applied studies adopted the copula-based methodology to examine e.g., agricultural droughts[64] or joint effects of temperature and precipitation extremes on vegetation growth.

[66][67] Copulas have been used to estimate the solar irradiance variability in spatial networks and temporally for single locations.

[68][69] Large synthetic traces of vectors and stationary time series can be generated using empirical copula while preserving the entire dependence structure of small datasets.

Copulas have been used for determining the core radio luminosity function of Active galactic Nuclei (AGNs),[73] while this cannot be realized using traditional methods due to the difficulties in sample completeness.

[76] Zeng et al.[77] presented algorithms, simulation, optimal selection, and practical applications of these copulas in signal processing.

validating biometric authentication,[79] modeling stochastic dependence in large-scale integration of wind power,[80] unsupervised classification of radar signals[81] fusion of correlated sensor decisions[94]