Global financial system

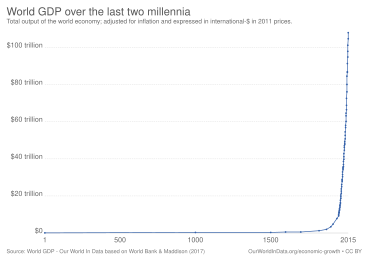

Since emerging in the late 19th century during the first modern wave of economic globalization, its evolution is marked by the establishment of central banks, multilateral treaties, and intergovernmental organizations aimed at improving the transparency, regulation, and effectiveness of international markets.

Efforts to revamp the international monetary system after World War II improved exchange rate stability, fostering record growth in global finance.

It also renders exposure to risks in international finance, such as political deterioration, regulatory changes, foreign exchange controls, and legal uncertainties for property rights and investments.

The system's design also considered the findings of the Pujo Committee's investigation of the possibility of a money trust in which Wall Street's concentration of influence over national financial matters was questioned and in which investment bankers were suspected of unusually deep involvement in the directorates of manufacturing corporations.

In addition to addressing the underlying issues that precipitated the international ramifications of the 1907 money market crunch, New York's banks were liberated from the need to maintain their own reserves and began undertaking greater risks.

European tensions and increasing political uncertainty motivated investors to chase liquidity, prompting commercial banks to borrow heavily from London's discount market.

Emergency measures were introduced in the form of moratoria and extended bank holidays, but to no effect as financial contracts became informally unable to be negotiated and export embargoes thwarted gold shipments.

[13]: 23–24 The U.K. government attempted several measures to revive the London foreign exchange market, the most notable of which were implemented on September 5 to extend the previous moratorium through October and allow the Bank of England to temporarily loan funds to be paid back upon the end of the war in an effort to settle outstanding or unpaid acceptances for currency transactions.

[19]: 125–126 The international ramifications of the Smoot-Hawley tariff, comprising protectionist and discriminatory trade policies and bouts of economic nationalism, are credited by economists with prolongment and worldwide propagation of the Great Depression.

Germany became the first nation to formally abandon the post-World War I gold standard when the Dresdner Bank implemented foreign exchange controls and announced bankruptcy on July 15, 1931.

[10]: 448 [25]: 22 The adjustable pegging enabled greater exchange rate stability for commercial and financial transactions which fostered unprecedented growth in international trade and foreign investment.

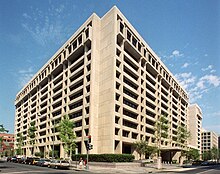

[26]: 38 While the IMF was instituted to guide members and provide a short-term financing window for recurrent balance of payments deficits, the IBRD was established to serve as a type of financial intermediary for channeling global capital toward long-term investment opportunities and postwar reconstruction projects.

[31]: 22 The creation of these organizations was a crucial milestone in the evolution of the international financial architecture, and some economists consider it the most significant achievement of multilateral cooperation following World War II.

[23]: 6–7 The system's erosion was expedited not only by the dollar devaluations that occurred, but also by the oil crises of the 1970s which emphasized the importance of international financial markets in petrodollar recycling and balance of payments financing.

[16]: 5–7 As part of the first amendment to its articles of agreement in 1969, the IMF developed a new reserve instrument called special drawing rights (SDRs), which could be held by central banks and exchanged among themselves and the Fund as an alternative to gold.

SDRs entered service in 1970 originally as units of a market basket of sixteen major vehicle currencies of countries whose share of total world exports exceeded 1%.

It legally formalized the free-floating acceptance and gold demonetization achieved by the Jamaica Agreement, and required members to support stable exchange rates through macroeconomic policy.

[26]: 62–63 [27]: 138 This role is called IMF surveillance and is recognized as a pivotal point in the evolution of the Fund's mandate, which was extended beyond balance of payments issues to broader concern with internal and external stresses on countries' overall economic policies.

After the 2000 stock market correction of the Dot-com bubble the country's trade deficit grew, the September 11 attacks increased political uncertainties, and the dollar began to depreciate in 2001.

Similarly to Bretton Woods however, EMS members could impose capital controls and other monetary policy shifts on countries responsible for exchange rates approaching their bounds, as identified by a divergence indicator which measured deviations from the ECU's value.

[47][48]: 3 In 2009, a newly elected government in Greece revealed the falsification of its national budget data, and that its fiscal deficit for the year was 12.7% of GDP as opposed to the 3.7% espoused by the previous administration.

National governments may employ their finance ministries, treasuries, and regulatory agencies to impose tariffs and foreign capital controls or may use their central banks to execute a desired intervention in the open markets.

[58][59] Research and academic institutions, professional associations, and think-tanks aim to observe, model, understand, and publish recommendations to improve the transparency and effectiveness of the global financial system.

Yet some European nations such as Portugal, Italy, and Spain continue to struggle with heavily leveraged corporate sectors and fragmented financial markets in which investors face pricing inefficiency and difficulty identifying quality assets.

[66]: 4 French economist and Executive Director of the World Economic Forum's Reinventing Bretton Woods Committee, Marc Uzan, has pointed out that some radical proposals such as a "global central bank or a world financial authority" have been deemed impractical, leading to further consideration of medium-term efforts to improve transparency and disclosure, strengthen emerging market financial climates, bolster prudential regulatory environments in advanced nations, and better moderate capital account liberalization and exchange rate regime selection in emerging markets.

Nations do not presently enjoy a comprehensive structure for macroeconomic policy coordination, and global savings imbalances have abounded before and after the 2008 financial crisis to the extent that the United States' status as the steward of the world's reserve currency was called into question.

The slow and often delayed implementation of banking regulations that meet Basel III criteria means most of the standards will not take effect until 2019, rendering continued exposure of global finance to unregulated systemic risks.

He argued that foreign crises have strong worldwide repercussions due in part to the phenomenon of moral hazard, particularly when many multinational firms deliberately invest in highly risky government bonds in anticipation of a national or international bailout.

Stiglitz has advocated finding means of stabilizing short-term international capital flows without adversely affecting long-term foreign direct investment which usually carries new knowledge spillover and technological advancements into economies.

He suggested other national regulators follow Canada in establishing staged intervention procedures and require banks to commit to what he termed "living wills" which would detail plans for an orderly institutional failure.