Imperfect competition

[2] The competitive structure of a market can significantly impact the financial performance and conduct of the firms competing within it.

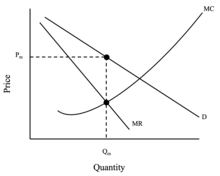

Firms are incentivised by profit, and hence undertake competitive strategies which reap the greatest revenue, by setting P > MC, at the cost of macroeconomic market efficiency.

Thus, imperfectly competitive pricing strategies impact consumer preferences and purchases, business operation and revenue, and economic policy.

[5] Utilising the assumptions of perfect competition, foreign trade policies advocate for minimal intervention.

In a perfectly competitive market, subsidies are harmful, and improvements to terms-of-trade are the first point of call for import protections.

[7] Conversely, imperfect competition assumptions promote intervention in the international trade market.

Therefore, the level of market power under monopolistic competition is contingent on the degree of product differentiation.

Thus, each firms' demand curve (unlike perfect competition) is downward sloping, rather than flat.

Oligopolies generally rely on non-price weapons, such as advertising or changes in product characteristics.

[9] The product they sell may or may not be differentiated and there are barriers to entry: natural, cost, market size or dissuasive strategies.

The major barriers are: A special type of Oligopoly, where two firms have exclusive power and control in a market.

Moreover, a monopoly is the sole provider of a good or service and thus, faces no competition in the output market.

Examples of monopolies include public utilities (water, electricity) and Australia Post.

The difference between monopoly and other models is that monopolists can price their products without considering the reactions of other firms' strategic decisions.

At this point: A firm is a Monopsonist if it faces small levels, or no competition in ONE of its output markets.

A natural monopoly occurs when it is cheaper for a single firm to provide all of the market's output.

However, restricting the profits of monopolists may also harm the interests of consumers, because companies may create unsatisfied products that are not available in new markets.

These products will bring positive benefits to consumers and create huge economic value for enterprises.

[4] The table below provides an overview of price competition and intensity in the four main classes of market structure.