Stock market

If a bid–ask spread exists, no trade immediately takes place – in this case, the DMM may use their own resources (money or stock) to close the difference.

[13][14] Rydqvist, Spizman, and Strebulaev attribute the differential growth in direct and indirect holdings to differences in the way each are taxed in the United States.

[14] In a 2003 paper by Vissing-Jørgensen attempts to explain disproportionate rates of participation along wealth and income groups as a function of fixed costs associated with investing.

The Italian historian Lodovico Guicciardini described how, in late 13th-century Bruges, commodity traders gathered outdoors at a market square containing an inn owned by a family called Van der Beurze, and in 1409 they became the "Brugse Beurse", institutionalizing what had been, until then, an informal meeting.

International traders, and specially the Italian bankers, present in Bruges since the early 13th-century, took back the word in their countries to define the place for stock market exchange: first the Italians (Borsa), but soon also the French (Bourse), the Germans (börse), Russians (birža), Czechs (burza), Swedes (börs), Danes and Norwegians (børs).

In most languages, the word coincides with that for money bag, dating back to the Latin bursa, from which obviously also derives the name of the Van der Beurse family.

Within the Communist countries, the spectrum of socialism ranged from the quasi-market, quasi-syndicalist system of Yugoslavia to the centralized totalitarianism of neighboring Albania.

One time I asked Professor von Mises, the great expert on the economics of socialism, at what point on this spectrum of statism would he designate a country as "socialist" or not.

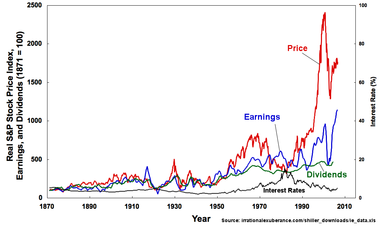

History has shown that the price of stocks and other assets is an important part of the dynamics of economic activity, and can influence or be an indicator of social mood.

Therefore, central banks tend to keep an eye on the control and behavior of the stock market and, in general, on the smooth operation of financial system functions.

[27] The smooth functioning of all these activities facilitates economic growth in that lower costs and enterprise risks promote the production of goods and services as well as possibly employment.

The 'hard' efficient-market hypothesis does not explain the cause of events such as the crash in 1987, when the Dow Jones Industrial Average plummeted 22.6 percent—the largest-ever one-day fall in the United States.

[33] This event demonstrated that share prices can fall dramatically even though no generally agreed upon definite cause has been found: a thorough search failed to detect any 'reasonable' development that might have accounted for the crash.

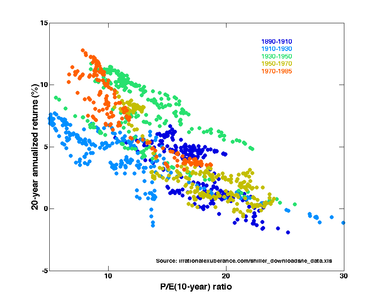

Moreover, while EMH predicts that all price movement (in the absence of change in fundamental information) is random (i.e. non-trending)[dubious – discuss],[34] many studies have shown a marked tendency for the stock market to trend over time periods of weeks or longer.

[36][37] Other research has shown that psychological factors may result in exaggerated (statistically anomalous) stock price movements (contrary to EMH which assumes such behaviors 'cancel out').

In the present context, this means that a succession of good news items about a company may lead investors to overreact positively, driving the price up.

[39] In normal times the market behaves like a game of roulette; the probabilities are known and largely independent of the investment decisions of the different players.

In parallel with various economic factors, a reason for stock market crashes is also due to panic and investing public's loss of confidence.

Black Monday itself was the largest one-day percentage decline in stock market history – the Dow Jones fell by 22.6% in a day.

This halt in trading allowed the Federal Reserve System and central banks of other countries to take measures to control the spreading of worldwide financial crisis.

In the United States the SEC introduced several new measures of control into the stock market in an attempt to prevent a re-occurrence of the events of Black Monday.

Sub-prime lending led to the housing bubble bursting and was made famous by movies like The Big Short where those holding large mortgages were unwittingly falling prey to lenders.

[48] Since the early 1990s, many of the largest exchanges have adopted electronic 'matching engines' to bring together buyers and sellers, replacing the open outcry system.

It serves several functions, including facilitating currency conversions, managing foreign exchange risk through futures and forwards, and providing a platform for speculative investors to earn a profit on FX trading.

[52][53] The electronic trading market refers to the digital marketplace where financial instruments such as stocks, bonds, currencies, commodities, and derivatives are bought and sold through online platforms.

They also provide features such as real-time market data, stock price analysis, research reports, and news updates, which support decision-making in trading activities.

Fundamental analysis refers to analyzing companies by their financial statements found in SEC filings, business trends, and general economic conditions.

One example of a technical strategy is the Trend following method, used by John W. Henry and Ed Seykota, which uses price patterns and is also rooted in risk management and diversification.

The principal aim of this strategy is to maximize diversification, minimize taxes from realizing gains, and ride the general trend of the stock market to rise.

[58] Taxation is a consideration of all investment strategies; profit from owning stocks, including dividends received, is subject to different tax rates depending on the type of security and the holding period.