Actuarial notation

Traditional notation uses a halo system, where symbols are placed as superscript or subscript before or after the main letter.

Various proposals have been made to adopt a linear system, where all the notation would be on a single line without the use of superscripts or subscripts.

Such a method would be useful for computing where representation of the halo system can be extremely difficult.

(pronounced "i upper m") is the nominal interest rate convertible

It merely represents the number of interest conversions, or compounding times, per year.

Semi-annual compounding, (or converting interest every six months), is frequently used in valuing bonds (see also fixed income securities) and similar monetary financial liability instruments, whereas home mortgages frequently convert interest monthly.

represents the present value of 1 to be paid one year from now: This present value factor, or discount factor, is used to determine the amount of money that must be invested now in order to have a given amount of money in the future.

By contrast, an annual effective rate of interest is calculated by dividing the amount of interest earned during a one-year period by the balance of money at the beginning of the year.

increases without bound: In this case, interest is convertible continuously.

In addition to the number of lives remaining at each age, a mortality table typically provides various probabilities associated with the development of these values.

is the number of people alive, relative to an original cohort, at age

As age increases the number of people alive decreases.

) are living and dying, the relationship between these two probabilities is: These symbols may also be extended to multiple years, by inserting the number of years at the bottom left of the basic symbol.

A life table generally shows the number of people alive at integral ages.

A common assumption is that of a Uniform Distribution of Deaths (UDD) at each year of age.

The following notation can then be added: If the payments to be made under an annuity are independent of any life event, it is known as an annuity-certain.

Otherwise, in particular if payments end upon the beneficiary's death, it is called a life annuity.

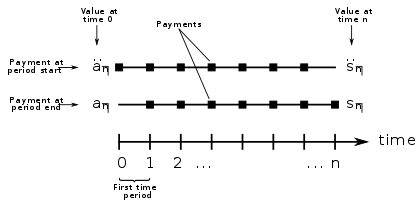

(read a-angle-n at i) represents the present value of an annuity-immediate, which is a series of unit payments at the end of each year for

represents the present value of an annuity-due, which is a series of unit payments at the beginning of each year for

is added to the top-right corner, it represents the present value of an annuity whose payments occur each one

The present values of these annuities may be compared as follows: To understand the relationships shown above, consider that cash flows paid at a later time have a smaller present value than cash flows of the same total amount that are paid at earlier times.

The age of the annuitant is an important consideration in calculating the actuarial present value of an annuity.

In the interest of simplicity the notation is limited and does not, for example, show whether the annuity is payable to a man or a woman (a fact that would typically be determined from the context, including whether the life table is based on male or female mortality rates).

The Actuarial Present Value of life contingent payments can be treated as the mathematical expectation of a present value random variable, or calculated through the current payment form.

indicates a life insurance benefit of 1 payable at the end of the year of death.

indicates a life insurance benefit of 1 payable at the end of the month of death.

indicates a life insurance benefit of 1 payable at the (mathematical) instant of death.

Among actuaries, force of mortality refers to what economists and other social scientists call the hazard rate and is construed as an instantaneous rate of mortality at a certain age measured on an annualized basis.

The approximate force of mortality is this probability divided by Δx.

If we let Δx tend to zero, we get the function for force of mortality, denoted as μ(x):

- An upper-case is an assurance paying 1 on the insured event; lower-case is an annuity paying 1 per annum at the appropriate time.

- Bar implies continuous – or paid at the moment of death; double dot implies paid at the beginning of the year; no mark implies paid at the end of the year;

- for -year-old person, for years;

- paid if dies within years;

- deferred ( years).

- No fixed meaning, implies the second moment to calculate but often implying double force of interest.