Deleveraging

At the micro-economic level, deleveraging refers to the reduction of the leverage ratio, or the percentage of debt in the balance sheet of a single economic entity, such as a household or a firm.

Deleveraging usually happens after a market downturn and hence is driven by the need to cover loss, which can deplete capital, build a less risky profile, or is required by nervous lenders to prevent default.

Deleveraging is frustrating and painful for private sector entities in distress: selling assets at a discount can itself lead to heavy losses.

Almost every major financial crisis in modern history has been followed by a significant period of deleveraging, which lasts six to seven years on average.

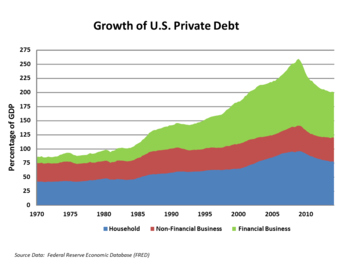

[3] This is mainly because the continuing rising of government debt, due to the Great Recession, has been offsetting the deleveraging in the private sectors in many countries.

[4] The McKinsey Global Institute defines a significant episode of deleveraging in an economy as one in which the ratio of total debt to GDP declines for at least three consecutive years and falls by 10 percent or more.

According to the McKinsey Global Institute, from 2007 to 2015, five developing nations and zero advanced ones reduced their debt-to-GDP ratio and 14 countries increased it by 50 percent or more.

In addition to causing deflation pressure, firms and households deleveraging their balance sheet often increase net savings by cutting expenditures sharply.

Deleveraging is responsible for the continuing fall in the prices of both physical capital and financial assets after the initial market downturn.

Some economists, such as Paul Krugman, have argued that in this case, fiscal policy should step in and deficit-financed government spending can, at least in principle, help avoid a sharp rise in unemployment and the pressure of deflation, therefore facilitating the process of private sector deleveraging and reducing the overall damage to the economy.